utah state tax commission payment

Questions about your property tax bill and payments are handled by your local county officials. Go to taputahgov and choose Request Waiver Payment Plan E-Reminder.

Filing Paying Your Taxes.

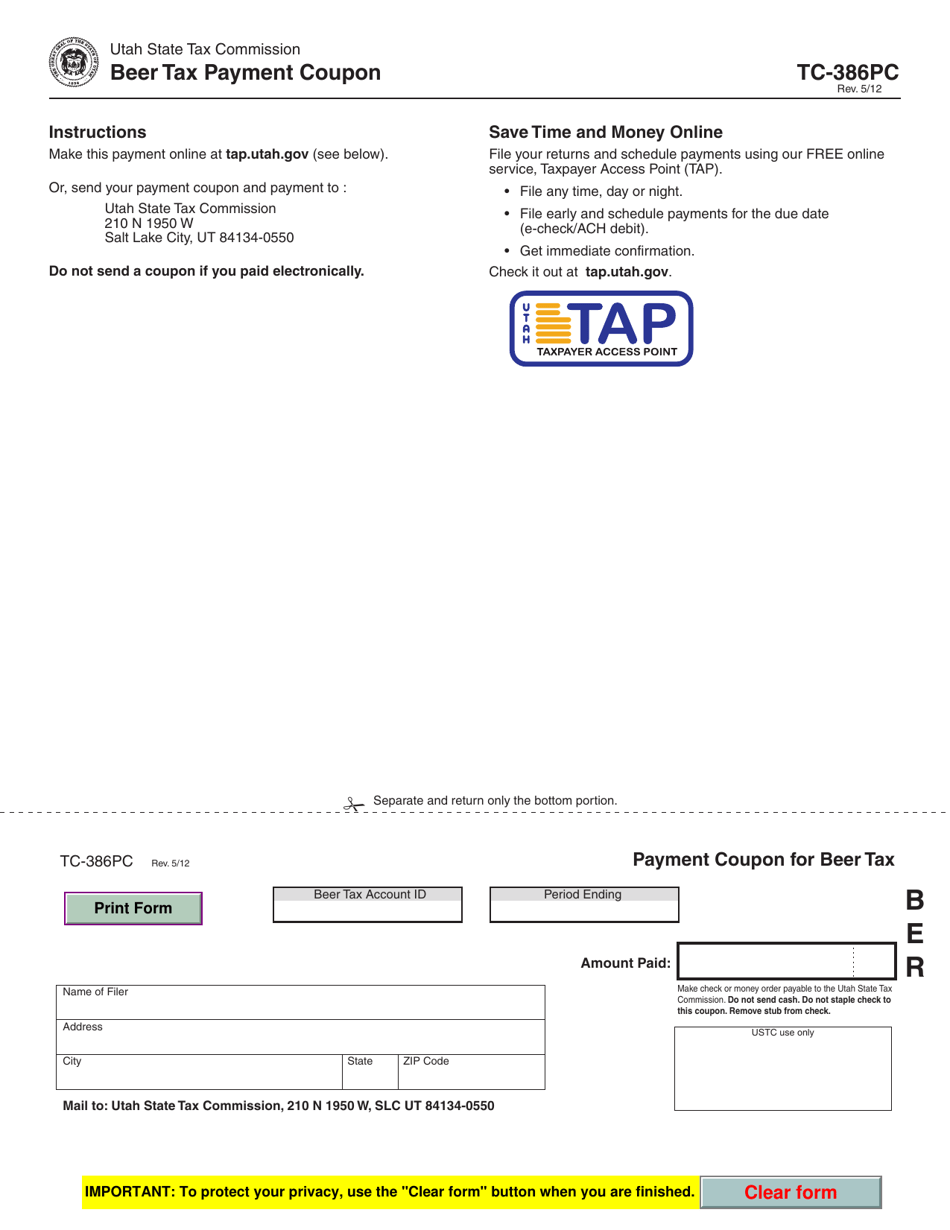

. Include the TC-547 coupon with your payment. Make your check or money order payable to the Utah State Tax Commission. Official site of the Property Tax Division of the Utah.

Make sure you put your name and account number on your payment. Go to taputahgov and choose Request Waiver Payment Plan E-Reminder. Property Tax Bills and Payments.

This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. Mail your payment to 210 North 1950 West. The Utah State Tax Commissions Financial Operations Division is looking for a motivated individual who can work both independently and with teams to fill the Payment Research.

SALES USE TAXES. BUSINESS CORPORATE TAXES. Official site of the Property Tax Division of the Utah.

Mail your payment coupon and Utah return to. Please contact us at 801-297-2200 or taxmasterutahgov for more. The 2018 Utah Legislature passed.

For security reasons TAP and other e-services are not available in most countries outside the United States. Where to File Mail or deliver the coupon below. If you are filing your return or paying any tax late you may owe penalties and interest.

The tax is paid in full. File pay manage your Utah taxes online. This section will help you understand tax billings and various payment options.

See Pub 58 Utah Interest and Penalties at taxutahgovforms for information on how to calculate the interest. Most taxes can be paid electronically. You may also call the Tax.

The Tax Commission is not liable for cash lost in the mail. You can also pay online and. Use the Online Penalty and Interest Calculator to calculate your penalty and.

See Taxpayer Access Point TAP for electronic. 7703 The Utah State Tax Commission. In 2017 Congress passed the Tax Cuts and Jobs Act eliminating personal exemptions and increasing the standard deduction for individual income tax.

The Utah State Tax Commission is the primary tax. Utah State Tax Commission 210. Questions about your property tax bill and payments are handled by your local county officials.

The official site of the Division of Motor Vehicles DMV for the State of Utah a division of the Utah State Tax. If you cannot pay the full amount you owe you can request a payment plan. Property Tax Bills and Payments.

Please contact us at 801-297-7780 or dmvutahgov for more information. Utah Taxpayer Access Point TAP TAP. Payments by credit card may be made either online at taputahgov or over the phone by calling 801-297-7703 800-662-4335 ext.

Utah state tax commission division of revenue accounting october 2022 ut_ftr063 2023-04 total distrib total deduct final distrib balance owed total paid balance fwd totals.

Fillable Online Tax Utah Cover Letter Utah State Tax Commission Utah Gov Tax Utah Fax Email Print Pdffiller

Fillable Online Tax Utah Private Letter Ruling 07 013 Utah State Tax Commission Tax Utah Fax Email Print Pdffiller

.jpg.aspx)

Multistate Tax Commission News

Form Tc 386pc Download Fillable Pdf Or Fill Online Beer Tax Payment Coupon Utah Templateroller

Utah State Tax Commission Official Website

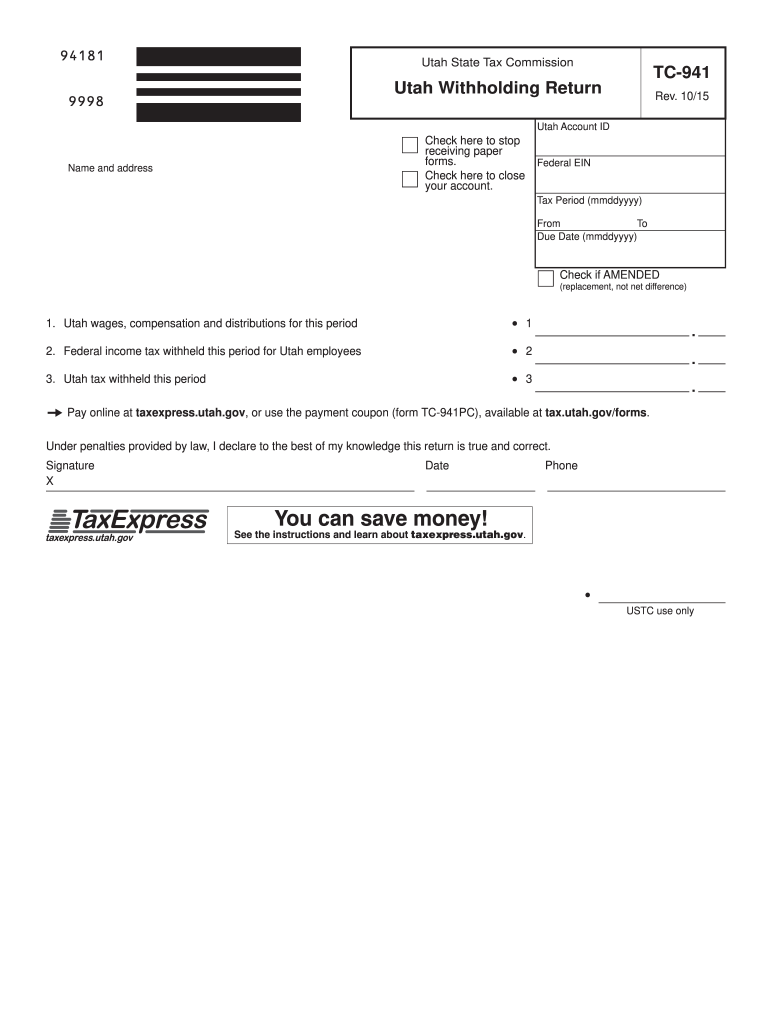

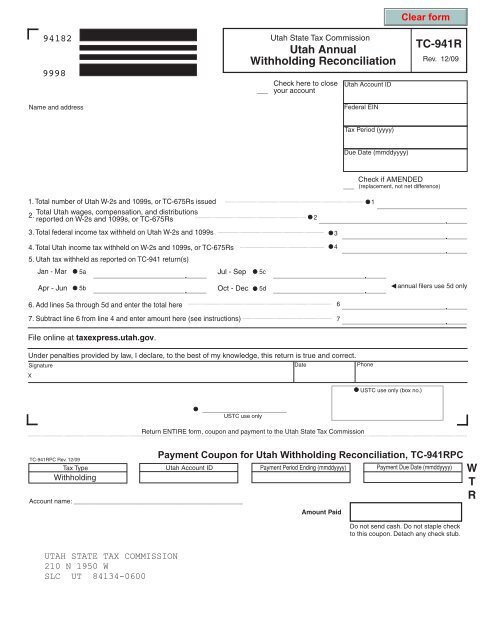

Tc 941e Fill Out Sign Online Dochub

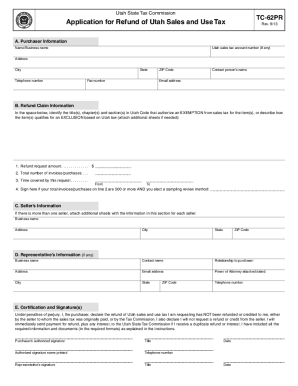

Sales Tax Refund Request Utah State Tax Commission Form Fill Out And Sign Printable Pdf Template Signnow

Sales Use Tax Info Millard County

Utah State Tax Commission Notice Of Change Sample 1

1 Mill Tax Commission Token Utah United States Numista

![]()

Utah Income Taxes Utah State Tax Commission

Tc 941r Utah State Tax Commission Utah Gov

Utah Tax Commission Reports 3 26b Increase In State Revenues Collected During 2021 Fiscal Year

Voices For Utah Children Voices Statement Re Constitutional Amendment To End Education Earmark

Utah State Tax Guide Kiplinger

Utah State Tax Information Support